The Expanding Wealth Divide

The Poverty Line’s Relentless Advance

The great civilisations of history have often risen and fallen on the back of economic disparity. The wealth divide, a topic once reserved for economic summits and research papers, is now an everyday discussion, resonating from the hallowed halls of academia to dining tables worldwide. This disparity paints a grim picture of the widening divide between the affluent and the underprivileged, an issue that demands attention.

Society’s wealth divide is not merely expanding—it is becoming alarmingly entrenched. This ever-deepening chasm between the affluent and the less privileged has dire implications for social cohesion, economic growth, and the very fabric of our societies. The poverty line isn’t just a statistic—it’s drawing closer for an increasing number of citizens in developed and developing nations alike.

The Statistics: A Revealing Snapshot

- United Kingdom: The UK, though recognised as one of the world’s premier economies, has exhibited worrying trends. 22% of its population resided below the poverty line. Moreover, the wealthiest 10% hold a staggering 44% of the country’s wealth, signifying an alarming disparity.

- United States: Often hailed as the land of opportunities, the US presents a concerning paradox. While it stands as the globe’s largest economy, its top 1% possesses more wealth than the entire middle class. Around 11.4% of its populace live in poverty.

- China: Despite its remarkable feat of lifting millions from poverty in the past few decades, China’s Gini coefficient, which measures income inequality, lingered at approximately 0.468 in 2020. This reveals a disconcerting spread of wealth.

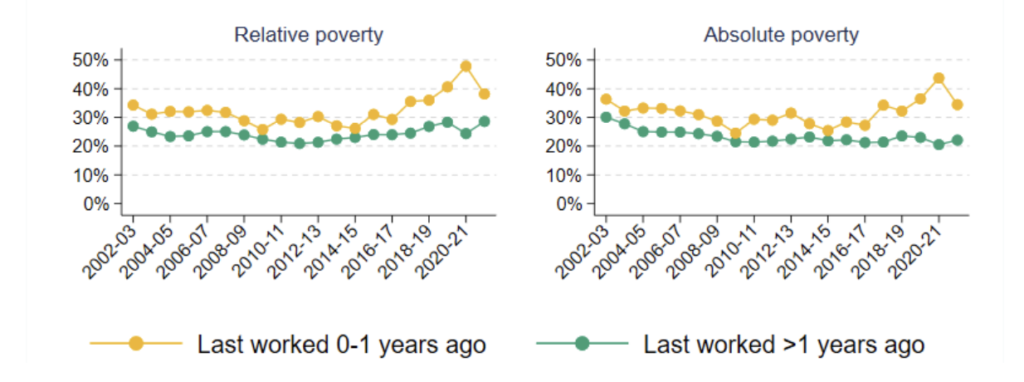

Source: Authors’ calculations using the Family Resources Survey, 2002–03 to 2021–22.

The Cultural Ramifications

Beyond mere numbers, the wealth divide permeates the cultural ethos of societies:

- Perception of Success: The narrative of success, particularly in Western societies, has become intrinsically linked to material wealth, often overshadowing other forms of accomplishment.

- Dissolution of the Middle Class: Once the backbone of modern economies, the middle class is under threat. As the poverty line draws nearer, this demographic, essential for societal stability, faces potential erosion.

- Generational Cycles: Wealth disparity is not merely a current issue; it threatens to entrap future generations. Children born into poverty have limited access to education and opportunities, perpetuating a cycle of deprivation.

Luxury as Investment: A Distinctive Symptom

As luxury’s highest spenders shift from purchasing to investing, it’s a poignant reflection of the wealth concentration. Auction houses facilitating the reselling of luxury items, and luxury goods yielding returns surpassing traditional assets, signify not just market dynamics but also the disproportionate accumulation of wealth in specific pockets of society.

The Investing Habits of Luxury’s Highest Spenders

It is a reflection of this expanding wealth divide when luxury’s highest spenders don’t merely buy—they invest. Their purchasing patterns have evolved in remarkable ways:

- Luxury’s highest spenders are redefining the very essence of their purchases—it’s now about leveraging and liquidity.

- Those splurging £39k+ annually on luxury are not just spending. They’re strategically investing.

- Cost of living crisis? Their finances have remained intact, and many are gearing up to maintain or even elevate their expenditure.

- A growing cohort is procuring luxury not for the joy of possession but with an intent to resell. And astonishingly, some luxury handbags and sneakers are now yielding returns that eclipse traditional investments like gold, real estate, and even the stock market.

- Cementing this trend, esteemed auction houses—Bonhams, Christie’s, and Sotheby’s—have forayed into pre-owned luxury accessories, facilitating their resale and further elevating their stature as tangible assets.

But what does this signify?

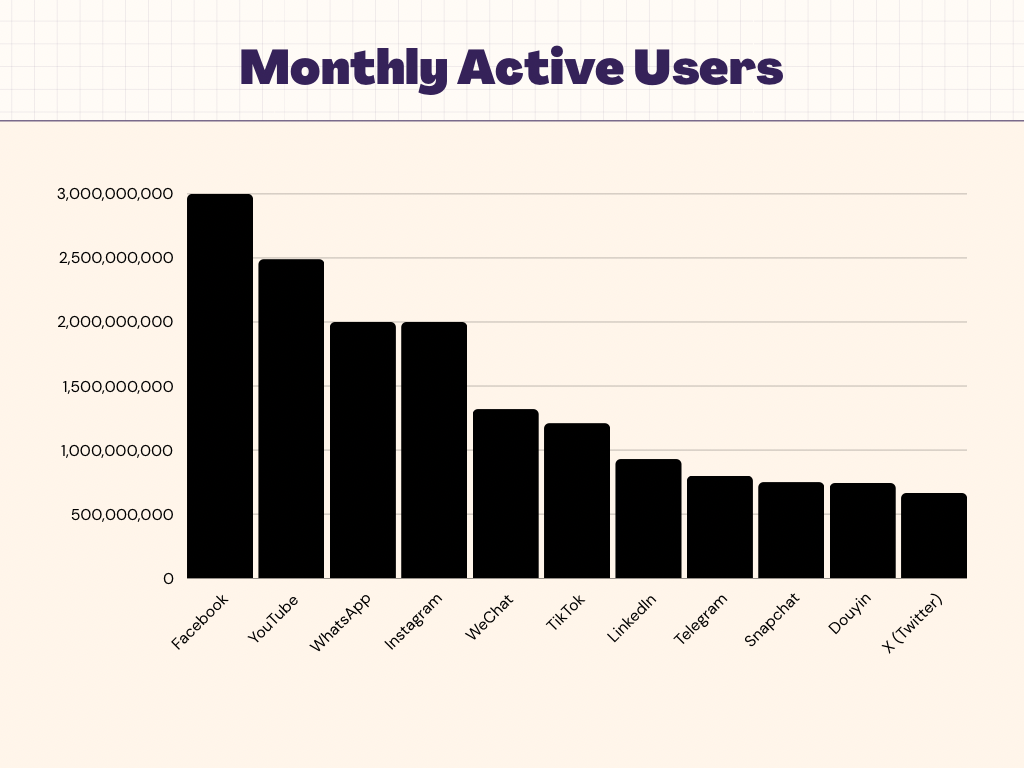

Social media, our modern mirror, reflects our aspirations, achievements, and even our investment portfolios. It’s no longer just about flaunting a high-end product but showcasing an asset that appreciates. It subtly underscores the disparities in our society, where the affluent not only have the means to buy luxury but to capitalise on it, amplifying their wealth.

Considering the socioeconomic angle, this trend highlights the widening gap between classes. The top tier doesn’t just possess luxury; they harness its potential, often propelled by insights and access unavailable to many.

In a world increasingly influenced by digital, these behavioural nuances shape perceptions, influence trends, and underscore the deepening chasm of economic disparity. In essence, for the crème de la crème, luxury has evolved from being a mere statement to a sophisticated strategy.

The Urgency of Wealth Redistribution

The transition of luxury from consumption to investment for the elite is indicative of a much larger, underlying issue. It’s a testament to the capital accumulation in one part of society while a significant portion struggles to meet basic needs.

This alarming wealth concentration not only amplifies societal imbalances but also threatens economic stability. History has shown that economies with pronounced wealth divides tend to experience sluggish growth, reduced social mobility, and heightened political unrest.

The urgency of the situation necessitates meaningful actions. Measures like progressive taxation, extensive wealth taxes (and I’m talking about the Billion dollar club – not the 6 six-figure-club). Along with initiatives to democratise access to education, healthcare, and job opportunities.

The echoes of wealth disparity aren’t mere economic debates; they’re moral, ethical, and existential challenges. As society stands at this juncture, the path chosen will determine not just fiscal trajectories but the very soul of global civilisation. Whether societies evolve towards more inclusivity or deepen existing divides will script the chronicles for future generations.

The narrative of luxury’s highest spenders is but a mirror, reflecting the stark realities of our time.